Irs Schedule D Instructions 2024 – The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual . In other words, someone with $100,000 in taxable income in 2024 would fall into the 22% bracket, but would owe a tax bill far below $22,000. Get your tax years straight Tax years can get confusing. .

Irs Schedule D Instructions 2024

Source : www.investopedia.com

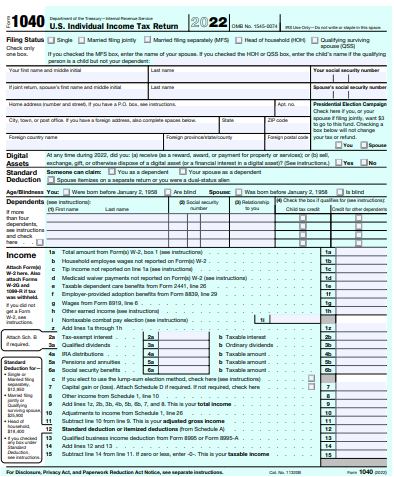

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

IRS launches paperless processing initiative for correspondence in

Source : newsismybusiness.com

Form 1040 SR U.S. Tax Return for Seniors: Definition and Filing

Source : www.investopedia.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

Tax cap at two percent for 2024 | The River Reporter

Source : riverreporter.com

IRS to Require Electronic Filing for ACA Reporting in 2024

Source : www.newfront.com

Ex Celsius CEO Alex Mashinsky’s Fraud Trial Set for September 2024

Source : www.bloomberg.com

Articles of interest related to business accounting, INTERAC

Source : www.intersoftsystems.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Irs Schedule D Instructions 2024 When Would I Have to Fill Out a Schedule D IRS Form?: The IRS has released higher federal tax brackets for 2024 to adjust for inflation. The standard deduction is increasing to $29,200 for married couples filing together and $14,600 for single taxpayers. . The Internal Revenue Service (IRS) on Thursday released updated tax brackets and standard deductions for 2024. While the actual percentages of the tax brackets will remain the same until 2025 .

:max_bytes(150000):strip_icc()/IRSScheduleD-c7be5030d7394773ad2d905654e9e902.png)

:max_bytes(150000):strip_icc()/IRSForm1040-SR-cabde4390e1b4590b59cf978edb7675e.png)